open end loan meaning

By contrast open-end loans such as credit cards can have the amount owed go up and down as the borrower takes money against a credit line. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as needed.

With a closed end loan if.

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

. A credit card is a kind of open-ended loan since the money is lent with no fixed end date. Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit. Open-end credit is a line of credit that may be used up to a specific preset limit.

An open-ended loan such as a credit card account or line of credit does not have a definite term or end date. Banking Credit An open-ended loan is an extension of credit where money can be borrowed when you need it and paid back on an ongoing basis such as a credit card. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

An open-ended loan is a loan that does not have a definite end date. A credit card is a kind of open-ended loan since the money is lent with no fixed end date. You get the open-end loan use the money you need pay it back when you can and you can reuse it when the balance shows that you have money on it.

An open-end loan is a more circular type of loan. Open-end loans are set for a fixed amount like the credit limit on a credit card. A closed-end loan allows.

It is a type of rotating credit wherein the borrower is entitled to get top up on the same loan subject to a. What are examples of open ended loans. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. An open ended loan tends to have higher interest rates because the risk to the lender is greater.

An agreement between a financial institution and borrower whereby the borrower is similarly allowed to borrow funds up to a preapproved dollar limit. Open-end mortgage saves borrower the effort of going somewhere else in search of a loan. Used to describe an investment fund in which shares can be bought at any time because there are.

Open-end mortgages combine the benefits of a traditional mortgage and a HELOC. Lets give an example of an open-end loan. An open-ended loan is an extension of credit where money can be borrowed when you need it and paid back on an ongoing basis such as a credit card.

Open-end mortgages can provide flexibility but limit you to what you were initially approved for. You take 10000 on an open-end loan. It is sometimes referred to as revolving credit.

There are several types of open-end credit. Therefore it can be more costly especially if the loan period continues over a greater length of time. Auto loans and boat loans are common examples of closed-end loans.

You can also choose to pay the loan off in one lump sum or even adjust your payment schedule allowing you flexibility and freedom in your repayment plan. Its circularity makes it more manageable as it doesnt have an end date. CIBC offers only open loans meaning you can prepay any amount of the loan that you wish without incurring penalty fees.

Generally speaking there are two primary forms of loans offered to individuals today those being open-end and closed-end loans. Open-end credit refers to. As a contrast to open-end credit closed-end loans are taken out for a specific reason like a car loan or mortgage.

Whereas an open-end loan allows borrowers to continually adjust their borrowing amount and pay back the funds they have used over an indefinite period of time a closed-end loan is far more stringent. An open-ended loan such as a credit card account or line of credit does not have a definite term or end date. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed.

Examples of open-ended loans include lines of credit and credit cards. Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period.

For example if you want to buy a car the loan can only be used for that car. As an open ended bridging loan has no final date there are no penalties for not meeting the deadline.

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

Emergency Loans Definition Types How To Get Them

Personal Line Of Credit Meaning How It Works Benefits And Drawbacks In 2022 Personal Line Of Credit Line Of Credit Types Of Loans

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

/top-6-reasons-new-businesses-fail.aspx_final-a6c9c5400448431c80dd8df79e4a7b16.png)

Top 6 Reasons New Businesses Fail

/cdn.vox-cdn.com/uploads/chorus_asset/file/20077490/GettyImages_1211427477.jpg)

The Ppp Loans To Help Small Businesses Were Flawed From The Start Vox

/letter-of-credit-474454659-ac5d6f45ce244478af87f92f1392884c.jpg)

Standby Letter Of Credit Sloc Definition

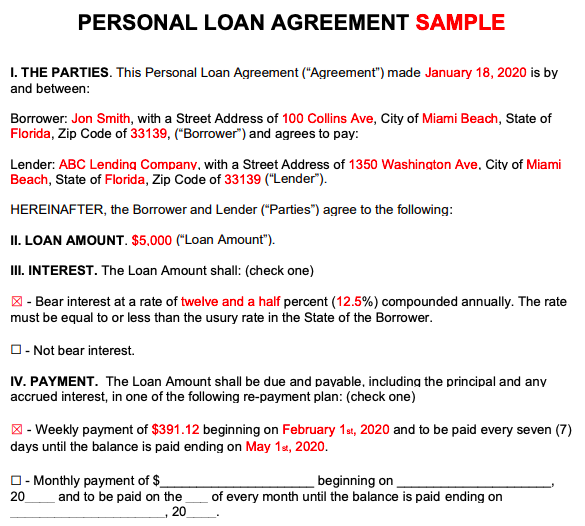

Personal Loan Agreements How To Create This Borrowing Contract

Are Car Loans Open Or Closed Car Loans Car Loan Calculator Loan Calculator

/close-up-of-credit-cards-580502979-3998b1e8a9d242c98648cc04ce236e8b.jpg)

Line Of Credit Loc Definition Types Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Are Car Loans Open Or Closed Car Loans Car Loan Calculator Loan Calculator

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/CandlestickDefinition3-a768ecdaadc2440db427fe8207491819.png)